Realigning Mass Market Wealth

TURNING SMALL ACCOUNTS INTO BIG BUSINESS

In 1964, Marshall McLuhan stated

“The Medium is the Message”.

It became true. In 2019, in financial services, “Client Experience is the Product”.

DISCLAIMER: Safe Harbour Statement

| While Agora Dealer Services (holding) Corp. (the “Company”) believes that the information in this presentation is current and correct as at the date of this presentation, it or its agents make no representations or warranties as to the accuracy or completeness, express or implied, of the information contained herein. Any work, opinions or research of third parties contained or referenced in this presentation are those of the third party and do not reflect the opinions of the Company. The information contained herein is subject to change without notice and the Company assumes no obligations to provide to the recipients of this presentation updated information subsequent to the date of this presentation. |

Neither this presentation nor anything provided herein constitutes an offer of securities, or should be construed to constitute an offer of securities, by the Company to any party. Any offer of securities, if ever made, will be made in accordance with securities laws. This document is being provided to you on a confidential basis solely to assist you in deciding whether or not to proceed with a further investigation of the Company. Accordingly, this document may not be reproduced in whole or in part, and may not be delivered to any other person without the consent of the Company. By accepting a copy of this presentation, you hereby accept and acknowledge these terms and conditions. |

MASSIVE DISRUPTION

Massive disruptor AirBnB transformed the hotel space by building a new platform to gain huge market share where no business existed before.

Internet

The Internet has transformed everything.

Computing Power

Computing power on top is changing every industry.

Platform Models

Platform business models already make up 10 of 20 global market cap leaders.

Portal

Portal Functionality & Experience are key.

A TRANSFORMATIVE ERA

1980

Fund Industry Emergence.

Product Sales Culture/High Growth.

1980’s

1990’s

Huge Growth / Bank Dominance.

Compliance / Competition / Technology lag.

2000

2020

Digital Economy / Advice for all.

Canada’s Financial Services Lag The World

THE SHIFT IS JUST THE BEGINNING…

The first wave was a threat to mutual fund or “Mass Market” advisors – robos.

As the second wave begins, technology utilization will determine who the winners & losers are.

A state of

UNDENIABLE CHANGE

Increasing Competition

Reducing Client Fees

Increasing Product Choice

Increasing Compliance Cost

Improve Operating Efficiencies

Find New Revenue Sources

Find Ways to Stay Competitive

Improve Client Connectivity Expectations

Increase Service & Product Options

A dawning Era of

TECHNOLOGY

Innovation and change in financial services.

Top 3 Dealer Concerns

Top 3 Dealer Obstacles

It Appears Rather Hopeless

How do dealers address concerns and obstacles & innovate at the same time?

TIME TO MOVE

Not for status quo

WINNERS

ADAPT TO NEW REALITY LEVERAGE TECHNOLOGY TO INCREASE VALUE TO MASS MARKET & UNLOCK UNFORESEEN PROFIT

- Increase product options (ETFs, GICs, etc.)

- Provide high net worth advice and services to all clients

- Manage escalating compliance more efficiently

- Improve cost management

LOSERS

REMAIN STATUS QUO THEY FAIL TO RECOGNIZE THE “TECHNOLOGICAL TSUNAMI” & THE DISRUPTION THAT IS UNDERWAY

- Remain embattled

- Suffer diminishing assets

- Reduced revenue

- Escalated compliance & administration costs

A future

WHERE DEALERS…

Are Able to Manage Compliance & Admin. Costs

Can Compete w/ Banks, Robos & New Entrants

Have Greater Product Option Availabilty

Enjoy Better Economics

Grow Their Share Of Robust Mass Market Assets

Generate Brand Loyalty Through Real Value

Deliver Powerful Client Connectivity & Experience

Fully Alignment With Regulation and Transparency

Clients

Assets

CONTRARIAN VIEW

INDUSTRY FOCUS IS ON THE HNW MARKET – 20% OF CLIENTS GENERATE 80% OF REVENUE

Agora went a different direction focusing on the largely ignored $800B “Mass Market” investors, paying $16B in annual fees.

The Market

There is $4.1T in our Marketplace. $800B held by Mass Market.

20% of ASSETS <$500,000

79% of HH BELOW $100K

90% of HH BELOW $500K

SOURCE: Investor Economics, Household Balance Sheet 2016 Report

ANALYSIS: Agora

The Average Investor

JOE & JANE

Fund assets continue robust growth – $1.6 Trillion

$800 Billion Market of Assets

$16 Billion fees/year.

It’s not profitable business for

dealers and advisors.

Turning the 80% of unprofitable business into a profit centre, then there is an extraordinary business model there.

AGORA

has solved the problem

Transformed dealer economics.

Reduced client account cost.

Increased revenue dramatically.

Improved Value Proposition.

Average Canadian Joe & Jane’s get more value for their $16B in annual fees.

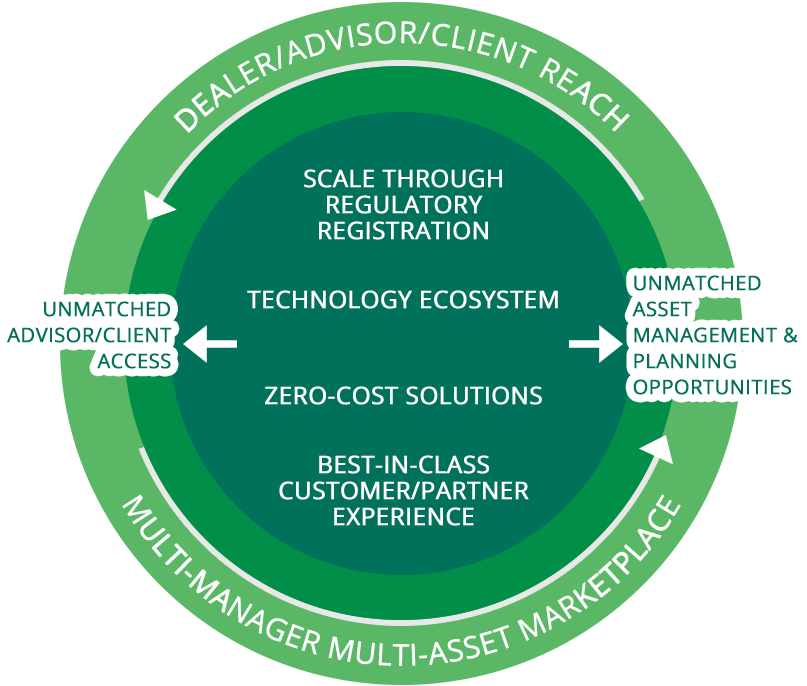

ABOUT AGORA

Proposition

Mass market gets higher quality wealth management and pays less.

We’ve made mass market accounts super profitable for our clients for the first time.

Business Model

B2B Platform. No advisors. No products. A highly efficient marketplace bringing all parties together.

Recurring Revenue

We don’t make money through transactions, we make it through recurring revenue on assets held at Agora.

Significantly lower Operating Costs on largest segment of their operations.

Automated administration – reduced costs – STP/PaaS.

Significant New Revenue on all mass market accounts.

Winning Formula for Clients

Agora is currently alone offering this capability

DEALER ECONOMICS

Game changer

Unlocking the hidden potential.

85% of clients = bottom half of Assets, contribute almost nothing to bottom line.

Current

| Dealer Revenue | 20 bps |

| EBITDA | 0-1 bps |

Agora’s Small Account Game Changer: Contributions from the 85%

| Dealer Rev. | 10bps + 20 existing bps = 30bps |

| in-Kind | 15 bps -Account Admin. 10 bps -3rd Party PM’s 5 bps -Technology Suite |

| Overall new | 40bps |

| Total dealer economics | 60 bps |

| EBITDA | 11-12 bps |

Redistribution of

MUTUAL FUND FEES

Cost of typical Cdn. Balanced Mutual Fund MER (200 bps)

Pricing includes dealer/advisor compensation

Dealer/Advisor 100 bps (50%)

Fund Company 100 bps (50%)

CURRENT MODEL

NEW MODEL

Redistribution of

MUTUAL FUND FEES

Cost of typical Cdn. Balanced Mutual Fund MER (200 bps) Pricing includes dealer/advisor compensation & redistribution to Agora

Dealer / Advisor 100 bps (50%)

Fund Company 50 bps (25%)

Agora 50 bps (25%)

15bps – Account Admin.

10bps – 3rd Party PM’s

5bps – Technology Suite

20bps – Agora

NO PORTFOLIO MANAGER FEES, NO NOMINEE ACCOUNT FEES, NO TECHNOLOGY OR E-ONBOARDING FEE, NO ADMIN FEES, NO TRANSFER OUT FEES, NO REBALANCING FEES.

VALUE IS THE PATH TO ADVISOR SUCCESS

Advisors have an Achilles heel – Too much admin, compliance, paperwork errors, so…client-facing time suffers.

Agora’s platform offers advisors the time to truly be present and add value to their client’s lives

An advisor can now deliver more advice and HNW wealth management to the mass market

Mass market investors can now get more value at same or lower cost

A future

FULL OF VALUE

Alignment to create a better client experience.

MASS MARKET INVESTORS

- Lower Cost (or nocost) accounts

- Portfolio Management Advice

- Consolidated Reporting

- No Transfer Out Fees

- Technology Expectations Met

FUND COMPANIES

- Lower Operating costs

- Omnibus Accounts

- Dealer Shelf Space

- Robust Support of “Independents”

- Zero Cost participation

- Portfolio Overlay to combat ETF’s

DEALERS

- Lower Operating Costs

- Recruiting/Retention value adds

- Compliance Improvement

- Technology Enhancements

- Continuous Technology subsidy

- No Conflict of Interest

ADVISORS

- Huge Time Saving (admin/compliance/ errors)

- Value Adds for Clients

- Compliance Protection

- Tech Enhancements & Continuing Tech Subsidy

- Retention of Independence

AGORA THE AIRBNB OF WEALTH MANAGEMENT

Agora is a cloud based on-line platform efficiently matching advisors & clients with high quality financial products, services & technology.

It connects dealers & their advisors with suppliers and facilitates the management of assets without owning any products or housing any advisors itself.

Agora cultivates a co-op community by joining dealers together for more efficient adoption and buying power.

Agora’s aspiration:

“Canada’s largest fund provider Agora, owns no funds”

The world’s largest hotelier AirBnB, owns no rooms.

INDUSTRY LEADING

PLATFORM

DEMAND

Efficient Engaged Recurring

40,000+ Advisors

4.9M+ End-Users

$800B+ Assets

SUPPLY PLATFORMS

Broad Diversified Free